|

The Three Gaps Every Business Owner Should Know

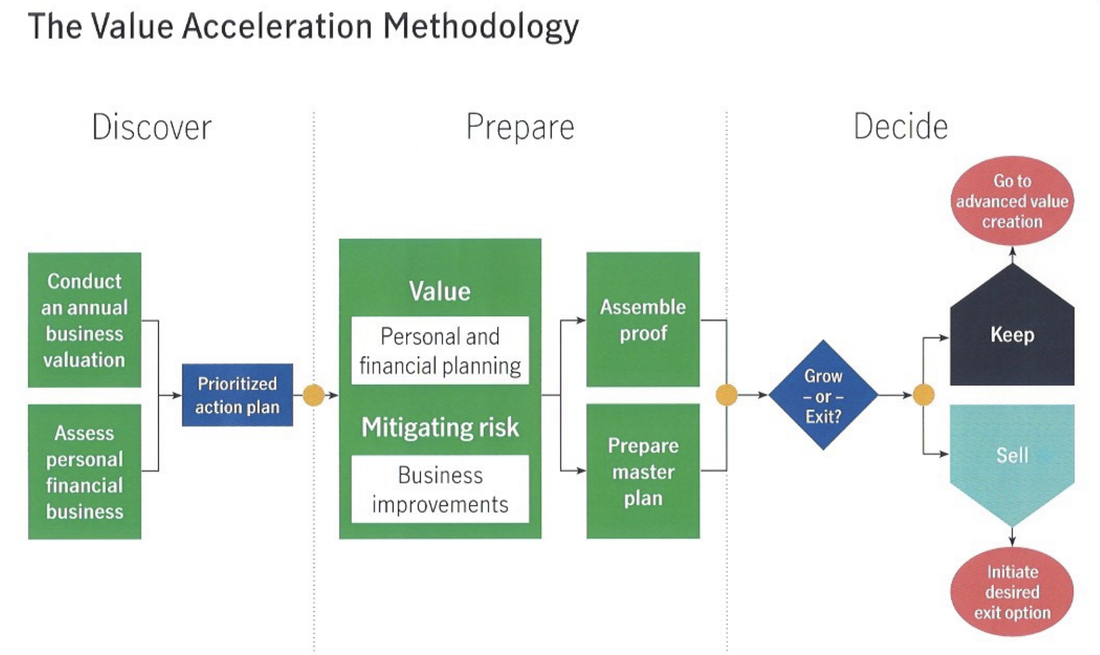

Whether you’re planning an exit from your business, now, in the future, or perhaps never, as a business owner, you should know these three potential gaps in your business planning strategy, as they could be crucial to your overall success. The Three Gaps are: Wealth, Profit, and Value Many business owners wonder how much their business is worth and how they stack up against their colleagues and competitors. Take the traditional country club evaluation for instance: a group of four business owners goes out on a Sunday to play a round of golf. One owner has just closed a big deal and sold their manufacturing company for millions of dollars. A fellow golfer, who owns a business in the same manufacturing space thinks, “I could probably sell my company for that much.” But what should the business owner sell their business for? What are the owner’s personal and financial goals? When talking about buying and selling companies, many business owners get caught up in the purchase price, when the real number they should be focused on is NET PROCEEDS. The ‘net proceeds’ of a sale refers to the cash the owners get at the close after taking care of all expenses, such as investment banking and transaction fees, accounting and legal fees, debt from the business, holdbacks, earnouts, seller financing and of course, maybe the biggest fee of all – TAXES. Although the net proceeds number is critical to determine what your business should sell for, it’s only part of the equation. Net proceeds help establish the three financial gaps in your life. Those gaps dictate what your business must sell for to live a fulfilled life after exit. Perhaps more importantly, because exit and succession planning are really just sound business strategies, they help to drive your results right now. The future is down the road, but you want to maximize your business’s performance now. You want to lower your tax burden now. You want to have a better handle on your business and life now-not just down the road at some point. The three gaps are the Wealth Gap, Profit Gap, and Value Gap. The first step is identifying your Wealth Gap. The Wealth Gap Your Wealth Gap is the difference between your current wealth and the amount you need to live the life you want. To understand your Wealth Gap, you must get clear on your personal goals and ambitions outside of your business. For example, the business owner who wants to own a minor league baseball team in the next phase of their life will require a lot more funds than an owner who wants to retire and live quietly on an old farm. Your personal goals, family, extended family, and personal aspirations should also be considered. Once identified, you can determine your Wealth Gap. Your net worth outside of your business plus the authentic value of your company today equals your goal. In other words, if your goal was $10 million and you had $2 million of assets outside of the business, your wealth gap would be $8 million. It’s not hard to imagine that a retirement, or ‘second act’ or next move in life would be a lot easier and more attainable at $10 million than $2 million. Contact us today at 810-603-9100 The Profit Gap Using our $10 million example, the next step in the process is understanding if the business today is, in fact, worth $8 million. To get to the root of this, start by calculating your company’s Profit Gap. At a very high level, a profit gap is calculated by understanding the best-in-class earnings before interest, taxes, depreciation, and amortization (known as EBITDA in business accounting circles) of businesses in the same industry. Next, you’ll assess your current EBITDA performance. The Profit Gap then is calculated by understanding how you can drive toward best-in-class performance by subtracting your firm’s current EBITDA performance from best-in-class performance. For example, if your company is currently valued at $1 million in EBITDA while the best-in-class companies are generating $3 million in EBITDA, your business currently has a $2 million Profit Gap. Contact us today at 810-603-9100 The Value Gap This EBITDA number is then applied to the sale price of the company. Small and lower middle market companies sell in a range of industry multiples, dictated by the private capital market. For example, upon research, a plastic manufacturing firm could be selling in a range of multiples from 1 x EBITDA to 6 x EBITDA, with the best-in-class companies selling at the higher range. Given the same industry research, you can now identify your company’s Value Gap. The Value Gap takes into consideration the best-in-class performance and applies it to your company. For example, if best-in-class companies are performing at 15% of EBITDA to revenue and your business is performing at 10% EBITDA to revenue, your firm could improve performance, even at the same level of revenue, and generate another 5% in EBITDA. To illustrate this further, imagine a company currently generates $20 million in annual revenue. At 15% EBITDA, this company would generate $3 million in EIBTDA, whereas, at 10% EBITDA, the company would generate $2 million in EBITDA. Given 15% EBITDA is best-in-class performance, these companies would likely sell at the best multiples. In this example, if best-in-class companies are selling at six times the EBITDA, that would be an $18 million sale price. An average company performing at 10% EBITDA, on the other hand, would likely sell for an average multiple. Let’s assume that multiple is 3.5 times the EBITDA, which would equate to a $7 million sale price. This would represent our existing example. Contact us today at 810-603-9100 Something else to consider: They say that things occur in threes…Have you ever heard of the Three Legs of the Stool? During the business evolution/exit/succession process, it’s important that you consider your 1) business, 2) personal, and 3) financial needs. All three of these are equally important for a successful business transformation or transition. We refer to these three components as the Three Legs of The Stool. Without all three equally balanced, the stool would topple over. This synergy helps to maximize the value of the business by helping ensure the owner is personally and financially prepared to maximize net proceeds and that they have a solid plan for what they’ll do next. The best time to start planning is NOW. Don’t hesitate to take advantage of our offer of a complimentary consultation to help assess your current situation, and perhaps start to identify and close your gaps so both you and your business can be stronger for longer. Contact us today at 810-603-9100 As a successful business owner, you may not be focused on any of this--you’re too busy running a winning enterprise. That’s where we come in. We can efficiently review your situation and help determine how you can best put a plan in to place that works to close your gaps and addresses all three legs of the planning stool, and helps you accelerate the value of your company - both now and in the future. Let us show you how! |

Schedule an appointment today! (810) 603-9100

|

The examples set forth in this article are hypothetical and not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.